In the ever-evolving landscape of artificial intelligence (AI), one of the most groundbreaking developments has been the advent of Generative Pre-trained Transformer (GPT) models. These sophisticated AI systems have not only transformed the way we interact with technology but also hold immense potential for shaping the future of various industries, including finance and trade. As businesses and investors look to capitalize on the capabilities of GPT models, it’s crucial to explore the emerging trends and innovations driving the future of GPT trade.

Understanding GPT Trade

Before delving into the future trends, let’s first understand what GPT trade entails. GPT models, such as OpenAI’s GPT-3, are designed to understand and generate human-like text based on the input they receive. This remarkable ability has led to their widespread adoption in applications ranging from content generation to customer service chatbots.

However, the potential of GPT extends far beyond these conventional use cases. In recent years, there has been a growing interest in leveraging GPT models for trade and investment purposes. GPT trade involves utilizing these AI systems to analyze market data, identify trends, and even make trading decisions autonomously.

Trends Shaping the Future of GPT Trade

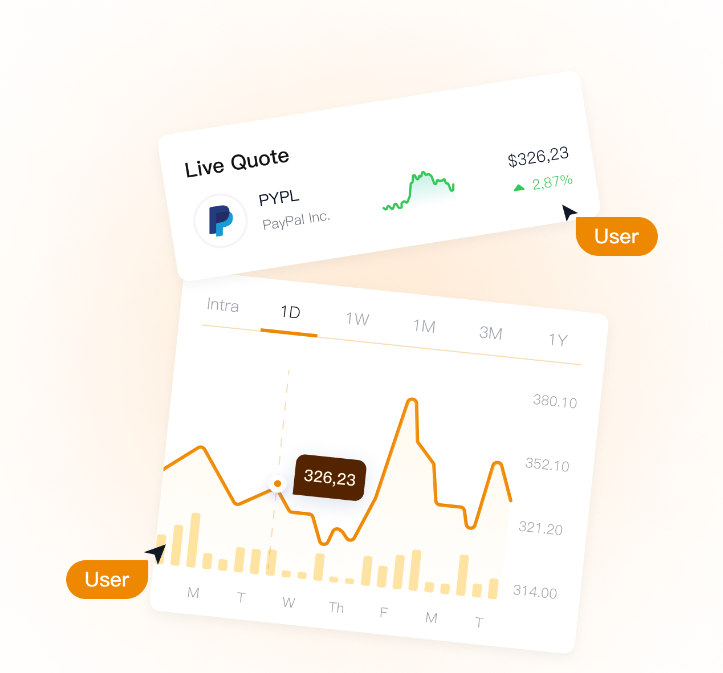

- Enhanced Market Analysis: One of the most significant trends in GPT trade is the refinement of market analysis capabilities. GPT models can process vast amounts of financial data in real-time, enabling traders to gain valuable insights into market trends and potential investment opportunities. With ongoing advancements in AI technology, these models are becoming increasingly adept at identifying patterns and predicting market movements with greater accuracy.

- Algorithmic Trading: Algorithmic trading, which involves the use of pre-defined instructions to execute trades automatically, is experiencing a revolution with the integration of GPT models. These AI systems can analyze market conditions and execute trades at speeds far beyond human capabilities. As a result, algorithmic trading powered by GPT is becoming more prevalent, offering traders a competitive edge in today’s fast-paced markets.

- Risk Management: Effective risk management is crucial in trading and investment strategies. GPT models are being employed to assess and mitigate risks by analyzing factors such as market volatility, economic indicators, and geopolitical events. By providing real-time risk assessments, these AI systems help traders make informed decisions and minimize potential losses.

- Personalized Investment Strategies: Another emerging trend in GPT trade is the development of personalized investment strategies. By leveraging machine learning algorithms, GPT models can analyze an individual investor’s preferences, risk tolerance, and financial goals to tailor investment recommendations accordingly. This level of customization empowers investors to build portfolios that align with their specific needs and objectives.

Innovations Driving GPT Trade

- GPT Fund Management: The concept of GPT fund management is gaining traction as more investment firms explore the potential of AI-driven strategies. GPT models can autonomously manage investment portfolios, dynamically adjusting asset allocations based on market conditions and performance metrics. This approach offers investors a hands-off approach to portfolio management while potentially maximizing returns.

- Natural Language Processing (NLP) Integration: Natural Language Processing (NLP) capabilities are integral to GPT models, allowing them to understand and generate human-like text. By integrating NLP technology into trading platforms, investors can interact with GPT systems using everyday language, making complex financial concepts more accessible and facilitating seamless decision-making processes.

- Interdisciplinary Collaboration: The future of GPT trade lies in interdisciplinary collaboration between AI experts, economists, and finance professionals. By bringing together diverse skill sets and perspectives, innovative solutions can be developed to address the complex challenges of modern trading environments. Collaborative efforts may result in the creation of hybrid models that combine GPT technology with traditional financial analysis techniques for enhanced performance and reliability.

The Future of GPT Trade: Opportunities and Challenges

As we look ahead, the future of GPT trade holds immense promise, but it also presents certain challenges that must be addressed. Opportunities abound for leveraging GPT models to revolutionize trading strategies, optimize investment portfolios, and democratize access to financial markets. However, concerns regarding algorithmic biases, data privacy, and regulatory compliance remain significant hurdles that must be overcome.

In conclusion, the future of GPT trade is characterized by innovation, collaboration, and the relentless pursuit of excellence in leveraging AI technology for financial gain. By staying abreast of emerging trends, embracing technological advancements, and fostering interdisciplinary partnerships, businesses and investors can unlock the full potential of GPT models in reshaping the future of trade and finance.